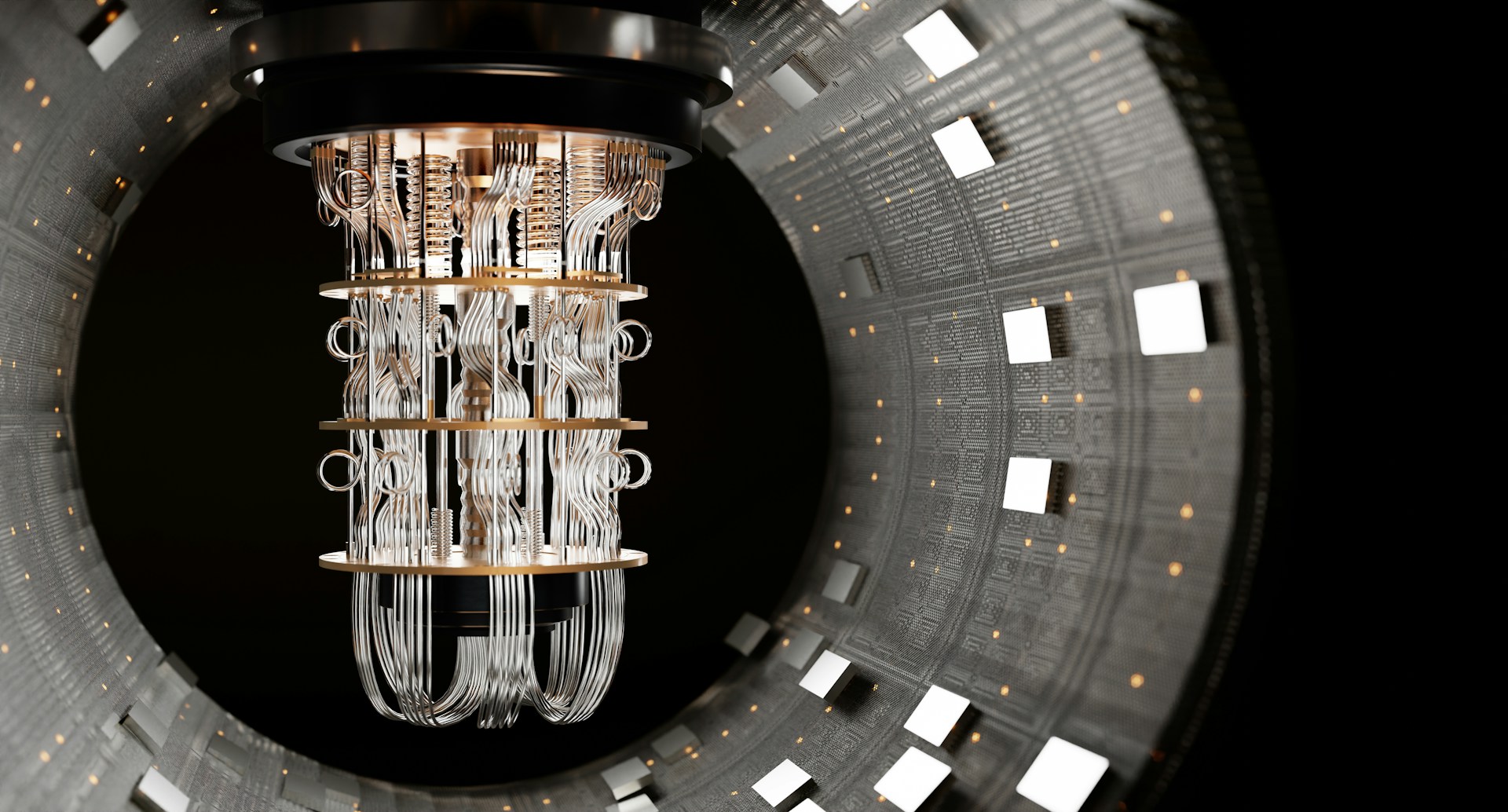

Quantum computing is moving from research labs into early financial-sector trials, offering institutions a new approach to modelling problems that have long strained the limits of classical computing. Banks and asset managers are testing quantum techniques to improve the precision and speed of risk analysis, portfolio construction and complex optimisation, reflecting a gradual shift toward practical adoption of technologies once viewed as speculative.

The strongest interest is in applications that involve vast datasets and highly variable outcomes. Quantum algorithms can process multiple states simultaneously, enabling more sophisticated simulations for stress testing and credit evaluation. These capabilities are particularly relevant in volatile markets where traditional models struggle to capture tail-risk scenarios or produce timely assessments. Early pilots suggest that quantum methods may enhance accuracy in estimating exposures, pricing uncertainty and evaluating potential losses under adverse conditions.

Investment teams are exploring quantum-enabled optimisation for portfolio decisions that involve thousands of variables. Classical techniques can become computationally costly as assets, constraints and scenarios multiply. Quantum approaches promise near-instant evaluations of alternative allocations, allowing analysts to compare outcomes more efficiently and adjust strategies with greater responsiveness. If these tools mature, they could become a differentiator for firms competing on speed and analytical depth.

Security also features prominently in the sector’s preparations. Advances in quantum processing threaten to undermine existing encryption standards, prompting financial institutions to assess their vulnerability and plan for quantum-resistant systems. This duality – opportunity and risk – is shaping how firms engage with the technology, balancing experimentation with caution as they consider long-term infrastructure requirements.

Despite intensified exploration, practical deployment remains constrained. Hardware limitations, error rates and the nascency of the software ecosystem mean quantum computing is still far from large-scale commercial use. Most activity is confined to research partnerships or controlled test environments, with timelines for broader rollout varying widely among institutions.